Behavioral Finance beschäftigt sich verkürzt ausgedrückt mit der Psychologie der Anleger. Die Aktionäre als Handelnde und ihre typischen Verhaltensweisen stehen im Mittelpunkt des Interesses. Im Grunde genommen geht es darum aufzuzeigen, wie Anlageentscheidungen tatsächlich zustande kommen und welche Fehler immer wieder gemacht werden. [Q] – Die dabei gewonnenen Erkenntnisse widersprechen der Effizienzmarkthypothese / Markteffizienzhypothese. Vertreter dieser Theorie behaupten, dass Anleger in der Regel irrational handeln.

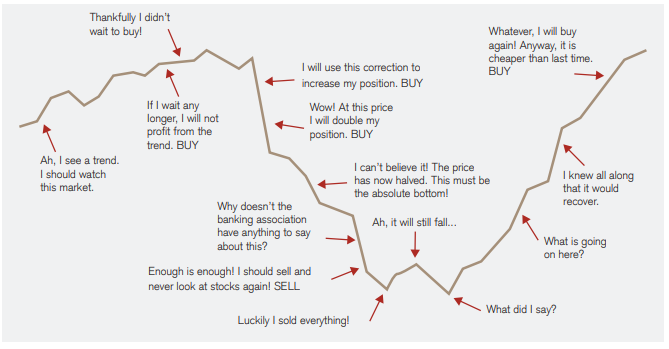

Roller Coaster of Emotions

Literatur

- Behavioral Finance I – III

- Introduction

- Roll, Richard – Foreward, S. XI-XII

- Shefrin, Hersh – Introduction Behavioral Finance I, S. XII-XXXI

- Shefrin, Hersh – Introduction Behavioral Finance II, S. XI-XXI

- Shefrin, Hersh – Introduction Behavioral Finance III, S. XIII-XXV

- Behavioral Foundations (I)

- SLOVIC, Paul. Psychological study of human judgment: Implications for investment decision making. The Journal of Finance, 1972, 27. Jg., Nr. 4, S. 779-799.

- TVERSKY, Amos; KAHNEMAN, Daniel. Judgment under uncertainty: Heuristics and biases. science, 1974, 185. Jg., Nr. 4157, S. 1124-1131. [Review]

- KAHNEMAN, Daniel; SLOVIC, Paul; TVERSKY, Amos. Judment Under Uncertainty; Heuristics and Biases (Buch)

- TVERSKY, Amos; KAHNEMAN, Daniel. Evidential Impact of Base Rates, 1982, 153-60 (Chapter 10)

- EDWARDS, Ward. Convervatism in Human Information Processing, 1982, 359-369 (Chapter 25)

- OSKAMP, Stuart. Overconfidence in Case-study Judgments, S 287-293 (Chapter 20)

- GRIFFIN, Dale; TVERSKY, Amos. The weighing of evidence and the determinants of confidence. Cognitive psychology, 1992, 24. Jg., Nr. 3, S. 411-435.

- Asset Pricing Theory (I)

- SHEFRIN, Hersh; STATMAN, Meir. Behavioral capital asset pricing theory. Journal of Financial and Quantitative Analysis, 1994, 29. Jg., Nr. 3.

- MILLER, Edward M. Risk, uncertainty, and divergence of opinion. The Journal of Finance, 1977, 32. Jg., Nr. 4, S. 1151-1168.

- BLUME, Lawrence; EASLEY, David. Evolution and market behavior. Journal of Economic theory, 1992, 58. Jg., Nr. 1, S. 9-40.

- SHLEIFER, Andrei; VISHNY, Robert W. The limits of arbitrage. The Journal of Finance, 1997, 52. Jg., Nr. 1, S. 35-55.

- ODEAN, Terrance. Volume, volatility, price, and profit when all traders are above average. The Journal of Finance, 1998, 53. Jg., Nr. 6, S. 1887-1934.

- Studies about Overreaction and Underreaction (I)

- BONDT, WERNER FM; THALER, Richard H. Further evidence on investor overreaction and stock market seasonality. The Journal of Finance, 1987, 42. Jg., Nr. 3, S. 557-581.

- RITTER, Jay R. The buying and selling behavior of individual investors at the turn of the year. The Journal of Finance, 1988, 43. Jg., Nr. 3, S. 701-717.

- JEGADEESH, Narasimhan; TITMAN, Sheridan. Returns to buying winners and selling losers: Implications for stock market efficiency. The Journal of Finance, 1993, 48. Jg., Nr. 1, S. 65-91.

- LAKONISHOK, Josef; SHLEIFER, Andrei; VISHNY, Robert W. Contrarian investment, extrapolation, and risk. The journal of finance, 1994, 49. Jg., Nr. 5, S. 1541-1578.

- BARBERIS, Nicholas; SHLEIFER, Andrei; VISHNY, Robert. A model of investor sentiment. Journal of financial economics, 1998, 49. Jg., Nr. 3, S. 307-343.

- DANIEL, Kent; HIRSHLEIFER, David; SUBRAHMANYAM, Avanidhar. Investor psychology and security market under‐and overreactions. the Journal of Finance, 1998, 53. Jg., Nr. 6, S. 1839-1885.

- HONG, Harrison; STEIN, Jeremy C. A unified theory of underreaction, momentum trading, and overreaction in asset markets. The Journal of Finance, 1999, 54. Jg., Nr. 6, S. 2143-2184.

- Competing Views (I)

- FAMA, Eugene F.; FRENCH, Kenneth R. Multifactor explanations of asset pricing anomalies. The journal of finance, 1996, 51. Jg., Nr. 1, S. 55-84.

- SOLT, Michael E.; STATMAN, Meir. Good companies, bad stocks. The Journal of Portfolio Management, 1989, 15. Jg., Nr. 4, S. 39-44.

- SEFRIN, Hersh; STATMAN, Meir. Making Sense of Beta, Size and Book-to-Market. Journal of Portfolio Management, 1995, 21. Jg, Nr. 2, S. 26-34.

- DANIEL, Kent; TITMAN, Sheridan. Evidence on the characteristics of cross sectional variation in stock returns. The Journal of Finance, 1997, 52. Jg., Nr. 1, S. 1-33.

- CONRAD, Jennifer; KAUL, Gautam. Long‐Term Market Overreaction or Biases in Computed Returns?. The Journal of Finance, 1993, 48. Jg., Nr. 1, S. 39-63.

- BALL, Ray; KOTHARI, S. P.; SHANKEN, Jay. Problems in measuring portfolio performance An application to contrarian investment strategies. Journal of Financial Economics, 1995, 38. Jg., Nr. 1, S. 79-107.

- LOUGHRAN, Tim; RITTER, Jay R. Long‐Term Market Overreaction: The Effect of Low‐Priced Stocks. The Journal of Finance, 1996, 51. Jg., Nr. 5, S. 1959-1970.

- FAMA, Eugene F. Market efficiency, long-term returns, and behavioral finance. Journal of financial economics, 1998, 49. Jg., Nr. 3, S. 283-306.

- Prediction (II)

- SOLT, Michael E.; STATMAN, Meir. How useful is the sentiment index?. Financial Analysts Journal, 1988, S. 45-55.

- DE BONDT, Werner PM. Betting on trends: Intuitive forecasts of financial risk and return. International Journal of forecasting, 1993, 9. Jg., Nr. 3, S. 355-371.

- ANDREASSEN, Paul B. Judgmental extrapolation and market overreaction: On the use and disuse of news. Journal of Behavioral Decision Making, 1990, 3. Jg., Nr. 3, S. 153-174.

- DE BONDT, Werner F.M. Earnings Forecasts and Share Price Reversals, Charlottesville, VA: The Research Foundation of the Institute of Chartered Financial Analsysts, S. 1-36

- LA PORTA, Rafael. Expectations and the Cross-selection of Stock Returns. Journal of Finance, 1996, 60. Jg., Nr. 5, S. 1715-1742.

- CZACZKES, Benjamin; GANZACH, Yoav. The natural selection of prediction heuristics: Anchoring and adjustment versus representativeness. Journal of Behavioral Decision Making, 1996, 9. Jg., Nr. 2, S. 125-139.

- AMIR, Eli; GANZACH, Yoav. Overreaction and underreaction in analysts‘ forecasts. Journal of Economic Behavior & Organization, 1998, 37. Jg., Nr. 3, S. 333-347.

- Market Reactions to the Predictions and Announcements (II)

- WOMACK, Kent L. Do brokerage analysts‘ recommendations have investment value?. The Journal of Finance, 1996, 51. Jg., Nr. 1, S. 137-167.

- MICHAELY, Roni; WOMACK, Kent L. Conflict of interest and the credibility of underwriter analyst recommendations. Review of Financial Studies, 1999, 12. Jg., Nr. 4, S. 653-686.

- LOUGHRAN, Tim; RITTER, Jay R. The new issues puzzle. The Journal of Finance, 1995, 50. Jg., Nr. 1, S. 23-51. [Presentation]

- LOUGHRAN, Tim; RITTER, Jay R. The operating performance of firms conducting seasoned equity offerings. The Journal of Finance, 1997, 52. Jg., Nr. 5, S. 1823-1850.

- IKENBERRY, David; LAKONISHOK, Josef; VERMAELEN, Theo. Market underreaction to open market share repurchases. Journal of Financial Economics, 1995, 39. Jg., Nr. 2, S. 181-208.

- MICHAELY, Roni; THALER, Richard H.; WOMACK, Kent L. Price reactions to dividend initiations and omissions: Overreaction or drift?. The Journal of Finance, 1995, 50. Jg., Nr. 2, S. 573-608.

- KLIBANOFF, Peter; LAMONT, Owen; WIZMAN, Thierry A. Investor Reaction to Salient News in Closed‐End Country Funds. The Journal of Finance, 1998, 53. Jg., Nr. 2, S. 673-699.

- Volatility in the Term Structure of Interest Rates (II)

- SHILLER, Robert J. The volatility of long-term interest rates and expectations models of the term structure. The Journal of Political Economy, 1979, S. 1190-1219.

- CAMPBELL, John Y.; SHILLER, Robert J. Yield spreads and interest rate movements: A bird’s eye view. The Review of Economic Studies, 1991, 58. Jg., Nr. 3, S. 495-514.

- FROOT, Kenneth A. New hope for the expectations hypothesis of the term structure of interest rates. The Journal of Finance, 1989, 44. Jg., Nr. 2, S. 283-305.

- DE BONDT, Werner FM; BANGE, Mary M. Inflation forecast errors and time variation in term premia. Journal of Financial and Quantitative Analysis, 1992, 27. Jg., Nr. 4.

- Volatility in Equity Markets (II)

- CAMPBELL, John Y.; SHILLER, Robert J. Valuation ratios and the long-run stock market outlook, Journal of Portfolio Management 1998, 24. Jg., Nr. 2, S. 11-26.

- CAMPBELL, John Y.; SHILLER, Robert J. Valuation ratios and the long-run stock market outlook: An update. National Bureau of Economic Research, 2001.*

- CAMPBELL, John Y.; SHILLER, Robert J. Valuation ratios and the long-run stock market outlook: An update. Advances in Behavioral Finance, 2005, 2. Jg., S. 173-201.*

- MODIGLIANI, Franco; COHN, Richard A. Inflation, rational valuation and the market. Financial Analysts Journal, 1979, S. 24-44.

- LEE, Charles; MYERS, James; SWAMINATHAN, Bhaskaran. What is the Intrinsic Value of the Dow?. The Journal of Finance, 1999, 54. Jg., Nr. 5, S. 1693-1741.

- SMITH, Vernon L.; SUCHANEK, Gerry L.; WILLIAMS, Arlington W. Bubbles, crashes, and endogenous expectations in experimental spot asset markets. Econometrica: Journal of the Econometric Society, 1988, S. 1119-1151.

- Options and Arbitrage (II)

- GILSTER JR, John E. Option Pricing Theory: Is‘ Risk-Free’Hedging Feasible?. Financial Management, 1997, S. 91-105.

- JARROW, Robert. Review of John E. Gilster, Jr.“ Option Pricing Theory: Is‘ Risk-Free’Hedging Feasible?“. Financial Management, 1997, S. 106-108.

- GASTINEAU, Gary L. Comment on John E. Gilster, Jr.“ Option Pricing Theory: Is‘ Risk-Free’Hedging Feasible?“. Financial Management, 1997, S. 109-113.

- SHEFRIN, Hersh. Irrational exuberance and option smiles. Financial Analysts Journal, 1999, S. 91-103.

- FROOT, Kenneth A.; DABORA, Emil M. How are stock prices affected by the location of trade?. Journal of Financial economics, 1999, 53. Jg., Nr. 2, S. 189-216.

- Foundation Works (III)

- MARKOWITZ, Harry. The utility of wealth. The Journal of Political Economy, 1952, 60. Jg., Nr. 2, S. 151-158.

- ROY, Andrew Donald. Safety first and the holding of assets. Econometrica: Journal of the Econometric Society, 1952, S. 431-449.

- KAHNEMAN, Daniel; TVERSKY, Amos. Prospect theory: An analysis of decision under risk. Econometrica: Journal of the Econometric Society, 1979, S. 263-291

- TVERSKY, Amos; KAHNEMAN, Daniel. Rational choice and the framing of decisions. Journal of business, 1986, S. S251-S278.

- LOPES, Lola L. Between hope and fear: The psychology of risk. Advances in experimental social psychology, 1987, 20. Jg., Nr. 3, S. 255-295.

- The Structure of Individual Investors‘ Portfolio (III)

- SHEFRIN, Hersh; STATMAN, Meir. Behavioral portfolio theory. Journal of financial and quantitative analysis, 2000, 35. Jg., Nr. 02, S. 127-151.

- THALER, Richard H. Mental Accounting Matters. Journal of Behavioral Decision Making, 1999, Jg. Nr. 12, 193-206.

- MCCONNELL, John J.; SCHWARTZ, Eduardo S. The origin of LYONs: A case study in financial innovation. Journal of Applied Corporate Finance, 1992, 4. Jg., Nr. 4, S. 40-47.

- BARBER, Brad M.; ODEAN, Terrance. Trading is hazardous to your wealth: The common stock investment performance of individual investors. The Journal of Finance, 2000, 55. Jg., Nr. 2, S. 773-806.

- DE BONDT, Werner FM. A portrait of the individual investor. European economic review, 1998, 42. Jg., Nr. 3-5, S. 831-844.

- RITTER, Jay R. How I Helped to Make Fischer Black Wealthier. Financial Management, 1996, 25. Jg. Nr. 4, S 104-7

- The Disposition Effect (III)

- ODEAN, Terrance. Are investors reluctant to realize their losses?. The Journal of finance, 1998, 53. Jg., Nr. 5, S. 1775-1798.

- ODEAN, Terrance. Do investors trade too much?.American Economic Review, 1999, Vol. 89, Nr. 5, S. 1279-1298.

- HEISLER, Jeffrey. Loss aversion in a futures market: An empirical test. Review of Futures Markets, 1994, 13. Jg., Nr. 3, S. 793-826.

- WEBER, Martin; CAMERER, Colin F. The disposition effect in securities trading: An experimental analysis. Journal of Economic Behavior & Organization, 1998, 33. Jg., Nr. 2, S. 167-184.

- HEATH, Chip; HUDDART, Steven; LANG, Mark. Psychological factors and stock option exercise. The Quarterly Journal of Economics, 1999, 114. Jg., Nr. 2, S. 601-627.

- Intertemporal Issues (III)

- ROZEFF, Michael. Lump-sum investing versus dollar-averaging. Journal of Portfolio management, 1994, S. 45-50.

- LEGGIO, Karyl B.; LIEN, Donald. An empirical examination of the effectiveness of dollar-cost averaging using downside risk performance measures. Journal of Economics and Finance, 2003, 27. Jg., Nr. 2, S. 211-223. *

- STATMAN, Meir. A behavioral framework for dollar-cost averaging. The Journal of Portfolio Management, 1995, 22. Jg., Nr. 1, S. 70-78.

- LEVIN, Laurence. Are assets fungible?: Testing the behavioral theory of life-cycle savings. Journal of Economic Behavior & Organization, 1998, 36. Jg., Nr. 1, S. 59-83.

- BENARTZI, Shlomo; THALER, Richard H. Myopic loss aversion and the equity premium puzzle. The quarterly journal of Economics, 1995, 110. Jg., Nr. 1, S. 73-92.

- LOPES, Lola L. When time is of the essence: Averaging, aspiration, and the short run. Organizational Behavior and Human Decision Processes, 1996, 65. Jg., Nr. 3, S. 179-189.

- ROSS, Stephen A. Adding Risks: Samuelsoh’s Fallacy of Large Numbers Revisited. Journal of Financial and Quantitative Analysis, 1999, 34. Jg., Nr. 3.

- FISHER, Kenneth L.; STATMAN, Meir. A behavioral framework for time diversification. Financial Analysts Journal, 1999, S. 88-97.

- SHAFIR, Eldar; DIAMOND, Peter; TVERSKY, Amos. Money illusion. The Quarterly Journal of Economics, 1997, 112. Jg., Nr. 2, S. 341-374.

- FEHR, Ernst; TYRAN, Jean-Robert. Does money illusion matter?. American Economic Review, 2001, S. 1239-1262. *

- COHEN, Randolph B.; POLK, Christopher; VUOLTEENAHO, Tuomo. Money illusion in the stock market: The Modigliani-Cohn hypothesis. The Quarterly Journal of Economics, 2005, 120. Jg., Nr. 2, S. 639-668. *

- BRUNNERMEIER, Markus K.; JULLIARD, Christian. Money illusion and housing frenzies. Review of Financial Studies, 2008, 21. Jg., Nr. 1, S. 135-180. *

- PONTIFF, Jeffrey. Excess volatility and closed-end funds. The American Economic Review, 1997, S. 155-169.

- Managerial Decision Making (III)

- LINTNER, John. Distribution of incomes of corporations among dividends, retained earnings, and taxes. The American Economic Review, 1956, 46. Jg., Nr. 2, S. 97-113.

- MILLER, Merton H. Behavioral rationality in finance: The case of dividends. Journal of Business, 1986, S. S451-S468.

- BENARTZI, Shlomo; MICHAELY, Roni; THALER, Richard. Do changes in dividends signal the future or the past?. The Journal of Finance, 1997, 52. Jg., Nr. 3, S. 1007-1034.

- GRULLON, Gustavo, et al. Dividend changes do not signal changes in future profitability. Available at SSRN 431762, 2003. *

- NISSIM, Doron; ZIV, Amir. Dividend changes and future profitability. The Journal of Finance, 2001, 56. Jg., Nr. 6, S. 2111-2133. *

- DEGEORGE, Francois; PATEL, Jayendu; ZECKHAUSER, Richard. Earnings Management to Exceed Thresholds*. The Journal of Business, 1999, 72. Jg., Nr. 1, S. 1-33.

- STATMAN, Meir; SEPE, James F. Project termination announcements and the market value of the firm. Financial Management, 1989, S. 74-81.

- STEIN, Jeremy C. Rational capital budgeting in an irrational world. National Bureau of Economic Research, 1996.

- Introduction

- weiterführende Literatur

- Behavioral Finance I

- ALLAIS, Maurice. The foundations of a positive theory of choice involving risk and a criticism of the postulates and axioms of the American school (1952). Springer Netherlands, 1979. [Springer]

- BAKSHI, Gurdip; CAO, Charles; CHEN, Zhiwu. Empirical performance of alternative option pricing models. The Journal of Finance, 1997, 52. Jg., Nr. 5, S. 2003-2049.

- Behavioral Finance II

- Behavioral Finance III

- Behavioral Finance I

Aktien & Medien

- Scheufele, Bertram; Haas, Alexander: Medien und Aktien. Theoretische Modelle und empirische Analysen zum Zusammenhang zwischen Börsenberichterstattung und Aktienkursen sowie Handelsvolumina deutscher Unternehmen. Wiesbaden: VS Verl. für Sozialwiss. 2008 [GoogleBooks | Amazon]

- Kitzmann, Arnold – Massenpsychologie und Börse: So bestimmen Erwartungen und Gefühle Kursverläufe [GoogleBooks | Amazon]

- Beck, Klaus – Wirtschaftsberichtserstattung in der Boulevardpresse [GoogleBooks | Amazon]

- Haas, Alexander; Scheufele, Bertram: Online-Portale und Aktienkurse – eine Zeitreihenanalyse der Wechselwirkungen zwischen Berichterstattung und Kursentwicklung für ausgewählte deutsche Unternehmen. in: Hagen, Lutz M.; Rössler, Patrick (Hrsg.): Massenmedien in der Marktwirtschaft / Mass Media in the Market Economy. Schriftenreihe der DGPuK, Bd. 29. Konstanz: UVK 2007

- Scheufele, Bertram; Haas, Alexander: Berichterstattung und Aktienkurse. Eine Zeitreihenanalyse der Wechselwirkungen zwischen Wirtschaftsberichterstattung und Aktienkursen ausgewählter deutscher Unternehmen. Vortrag auf der DGPuK-Jahrestagung, 18. bis 19. Juni in Dresden

- Heun, Michael: Finanzmarktsimulation mit Multiagentensystemen: Entwicklung eines methodischen Frameworks [GoogleBooks | Amazon]

- Cohen-Charash Y, Scherbaum CA, Kammeyer-Mueller JD, Staw BM (2013) Mood and the Market: Can Press Reports of Investors‘ Mood Predict Stock Prices? PLoS ONE 8(8): e72031. doi:10.1371/journal.pone.0072031

- Stanzel, Matthias – Qualität des Aktienresearch von Finanzanalysten: Eine theoretische und empirische Untersuchung der Gewinnprognosen und Aktienempfehlungen am deutschen Kapitalmarkt [GoogleBooks | Amazon]

- Montier, James – Die Psychologie der Börse: Der Praxisleitfaden Behavioural Finance [GoogleBooks | Amazon]

- Strebel-Aerni, Brigitte – Finanzmärkte im Banne von Big Data

Diplomarbeit / Seminararbeit

Artikel

- Mewes, Hans-Werner & Wachinger, Benedikt & Stümpflen, Volker – Mit semantischem Text Mining von biologischen Netzwerken zum Börsenkurs

Bücher:

Google Scholar: